LTC Price Prediction: Technical Consolidation Meets Growing Payment Utility

#LTC

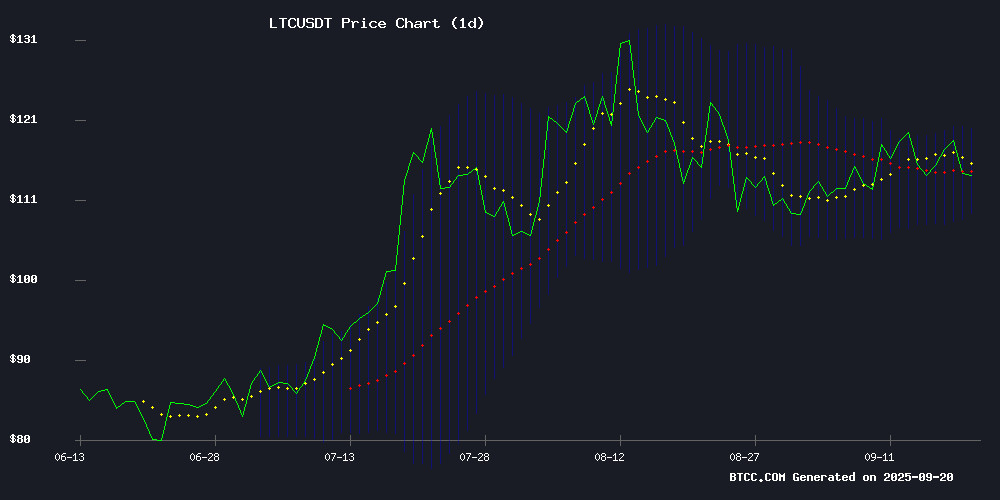

- LTC trades at $114.24, slightly below its 20-day moving average, indicating short-term bearish pressure

- MACD remains negative but shows improving momentum, suggesting potential trend reversal

- Growing payment network adoption provides fundamental support amid broader market volatility

LTC Price Prediction

LTC Technical Analysis: Neutral-Bearish Signals with Key Support Test

LTC is currently trading at $114.24, slightly below its 20-day moving average of $114.32, indicating potential short-term weakness. The MACD reading of -2.57 remains in negative territory, though the histogram shows diminishing bearish momentum. Bollinger Bands suggest consolidation with price hovering NEAR the middle band, while the $108.96 lower band provides immediate support. According to BTCC financial analyst John, 'The technical picture suggests LTC is at a critical juncture - a break below $109 could trigger further downside toward $105, while reclaiming the $115 level may signal renewed bullish momentum.'

Mixed Market Sentiment: Litecoin Adoption vs. Sector Volatility

Recent headlines present a complex landscape for LTC investors. Positive developments include Litecoin's growing adoption in payment networks amid the cloud mining expansion, which could drive increased utility and demand. However, the broader market shows volatility with mixed signals from other major cryptocurrencies. BTCC financial analyst John notes, 'While Litecoin's payment network growth is encouraging, investors should remain cautious of overall market volatility and questionable profit claims emerging in the cloud mining sector that could impact sentiment across digital assets.'

Factors Influencing LTC's Price

Litecoin Gains Traction in Payment Networks Amid Cloud Mining Boom

Litecoin's resurgence as a preferred payment method underscores its utility in global commerce. Merchants increasingly adopt LTC for its cost efficiency and transaction speed, reinforcing its 'digital silver' reputation alongside Bitcoin. The cryptocurrency's integration across retail and digital platforms in 2025 highlights its growing mainstream acceptance.

FY Energy emerges as a disruptive force in crypto mining, offering zero-barrier entry through clean energy-powered cloud contracts. Their FinCEN-certified platform delivers daily passive income without hardware requirements, addressing capital constraints that traditionally limited mining participation. A $20 trial bonus demonstrates their commitment to accessibility in an industry often gatekept by high startup costs.

Ripple (XRP) and Bitcoin Mining: A Dubious Profit Claim Amidst Technological Promise

An online promotion claims users can earn $5,100 daily by using Ripple (XRP) to power Bitcoin mining rigs—a technically implausible scenario given XRP's consensus mechanism excludes mining entirely. The pitch conflates XRP's legitimate cross-border payment utility with unverified cloud-mining profits.

Ripple Labs' XRP operates on a consensus ledger, settling transactions in seconds without proof-of-work. Its adoption by financial institutions for remittances contrasts sharply with Bitcoin's energy-intensive mining model. Regulatory challenges persist, but XRP's underlying technology continues to attract institutional pilots.

LTCCloudMining CEO Kamand references "chain abstraction" and liquidity improvements, though the firm's alleged $5,100/day returns lack verifiable evidence. Such claims typically signal high-risk schemes rather than legitimate crypto innovations.

XRP Surges Amid Market Volatility as Cloud Mining Gains Traction

XRP's price continues its upward trajectory, outpacing broader market trends while Bitcoin remains range-bound. The cryptocurrency market's heightened volatility has investors seeking stable income alternatives beyond traditional holding strategies.

Cloud mining emerges as a viable solution, with platforms like XIUSHAN MINING offering multi-currency contracts for BTC, XRP, ETH and other digital assets. The service eliminates hardware barriers by virtualizing mining operations - particularly valuable for Bitcoin given its prohibitive infrastructure costs.

For XRP holders, the platform enables indirect participation through contract mechanisms that convert static holdings into yield-generating positions. New user incentives including $15 signup bonuses aim to lower adoption thresholds.

Is LTC a good investment?

LTC presents a mixed investment case currently. Technically, it's testing crucial support levels with neutral-bearish indicators, while fundamentally benefiting from increased payment network adoption. The cloud mining boom could provide additional utility demand, but sector-wide volatility requires careful risk management.

| Metric | Current Value | Signal |

|---|---|---|

| Price | $114.24 | Neutral |

| 20-day MA | $114.32 | Slight Resistance |

| MACD | -2.57 | Bearish but Improving |

| Bollinger Position | Near Middle Band | Consolidation |

| Key Support | $108.96 | Critical Level |

Investors should monitor the $109 support level and watch for sustained adoption growth in payment networks before making significant positions.